8 Types of Commonly Used Business Source Documents

Introduction to Source Documents

Organizations have funds filtering in and out of their financial department every day, making it hard to keep things straight. Therefore, businesses need proper documentation that records details from each internal and external transaction.

Business source documents outline the details of every purchase and sale so that companies can check their books for accuracy.

What are Business Source Documents?

Business source documents are reports that outline business transactions, also known as an audit trail. These documents are necessary to keep when it comes time for auditors to review financial statements and verify purchases.

A source document defines the critical information of each transaction, including

- Names of the involved parties

- Purchase amount

- Transaction date

- Transaction source

- Authorized signature

- Other relevant details

Source documents are usually assigned an identification number and stamped for approval, ensuring the purchase was verified and making it easy to locate. Otherwise, it may be difficult to discern if forms are missing.

After checking and approving the documents, businesses then archive them in an organized filing system for future reference. Companies typically keep forms within the year on-site, while older reports can move to storage.

However, some organizations use cloud storage to keep all source documents in one universal interface for easy retrieval.

Types of Accounting Source Documents

A source document is a relatively broad term, as there are at least eight different types of paperwork that source documents include.

Quotes

Quotes are a type of report that suppliers give to interested clients, which outline the prices for the desired goods. The customers can look over the price assessments and determine which vendor to buy from, typically based on the cheapest option.

Once the client reviews the quote, they submit their order to the supplier, who then responds with an invoice after the products are shipped.

Purchase Orders

In order for businesses to purchase inventory, they need to complete an order form, also known as a purchase order. Sometimes the suppliers provide this document to their clients, while other times, companies must construct an A5 sheet. However, digital order forms use integrated software so that the financial department can pass the document through the appropriate teams.

After the approval process, project managers send the order source document to the vendor. At this point, the supplier begins the order fulfillment process and returns an invoice. These types of source documents do not always outline the order price, as sometimes it is not known until after fulfillment.

Delivery Dockets

Most often, vendors provide a delivery docket with each order being shipped, stamped, or delivered. This document, also known as a shipping slip, provides a description of the package's content.

This enables the receiving team to cross-examine the physical inventory with the record to ensure everything is present. If anything is missing or damaged, the client can contact the supplier and request a refund.

Sales and Purchase Invoices

When a company sells an item, they issue a report that details all pertinent information from the sale. However, if the seller does not receive the funds upfront, they will send an invoice to the buyer. An invoice states the following.

- Payment terms

- Buyer's information

- Seller's information

- Date of transaction

- Shipping details

For example, a store may give customers 30 days to pay off large purchases, such as a television or refrigerator. Depending on the payment terms, the outstanding balance may be accruing interest after the month is up. When the client receives the invoice, they cross-examine the details to the physical delivery to ensure everything is correct. After the approval process, the buyer then makes their payment in increments or in full.

Once the seller receives the fulfilled sales invoice, they enter it into their recordkeeping system for future reference.

Credit and Debit Notes

If the buyer decides they no longer want an item, they begin the returns process. When the seller approves the return, they issue what is known as a credit note. This type of source document shows the supplier that the customer has store credit on their account.

If the client has an outstanding balance from a previous purchase, the credit note reduces the amount. Otherwise, the form acts as a refund that can only be spent within the store. Either way, the seller marks this return as a debit note, as it reduces their available funds.

Payment Advices

Customers send a remittance, or payment, advice to their supplier after paying their invoice. This type of source document outlines the amount paid and the corresponding invoice number. The payment is either made through a check or electronic deposit, as long as it is traceable.

Typically, sellers attach the remittance advice at the bottom or alongside the right edge of the invoice. These perforated sections make it easy to tear off and send in for quick payments. Some even come with a duplicate so customers can have one for their records.

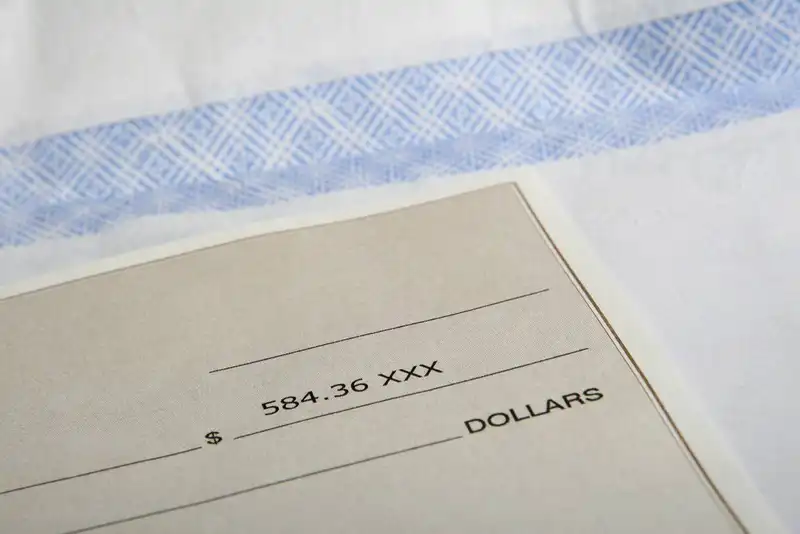

Checks

A check is a banknote that shows how much the account holder is withdrawing from their bank account. This type of source document requires an authorized signature from the account holder to begin processing. Each check has a unique number in the top right corner that makes it easy to correlate purchases. Bookkeepers typically record this number alongside the relevant purchase for future reference.

In this case, the payee, or the supplier, is written on the "Pay to the order of" line. If this line is left blank, anyone can write their own name and steal funds. Some businesses have the words "Non-negotiable" or "Or bearer" written on the top of their checks.

By crossing these words out, the payer prohibits the payee from cashing the check. Therefore, the only option is to deposit the check into the appropriate account and receive a deposit slip. All deposit slips should also be noted on the bank statement and recorded on the company's income statement.

Receipts

Once the customer pays their bill, the seller issues a receipt that details the order and payment terms. This source document is proof that the seller fulfilled the order and the client paid the balance.

Receipts are always a good idea, but especially when customers pay in cash, as there is no other paper trail. Nowadays, clients can receive a cash receipt on paper or digitally through their email.