What Is Financial Data Analytics and Why Does It Matter?

Introduction to Financial Data Analytics

The modern market is quickly evolving each day as technology advances and new demands arise. To evaluate these trends and to make informed business decisions, organizations must perform financial data analytics. This process allows executive teams to develop brand visions and goals and create financial policies. It also helps companies make better investments and protect their overall bottom line.

What is Financial Data Analytics?

Financial data analytics is the process of assessing a company's finances and value in the market. It entails examining historical data to gain visibility into the company's financial health in real-time. These data sets include sales, purchasing, and consumer information. Most organizations will also leverage their financial data analysis to calculate their profits and to forecast their future. The following factors are why analyzing finances is an important task for businesses.

- Analytics help management and senior-level teams make important organizational decisions

- Businesses can make informed and sound financial planning and forecasts

- Teams can develop new business models that align with evolving finances and new technology

- Existing business strategies are improved with data-driven insights

- Assessing financial data in conjunction with predictive analytics will highlight opportunities to enhance profitability and fuel cash flow

- Teams will gain insight into how they can measure and manage their assets and capital

- Organizations can reduce wasteful spending and implement techniques to increase revenue

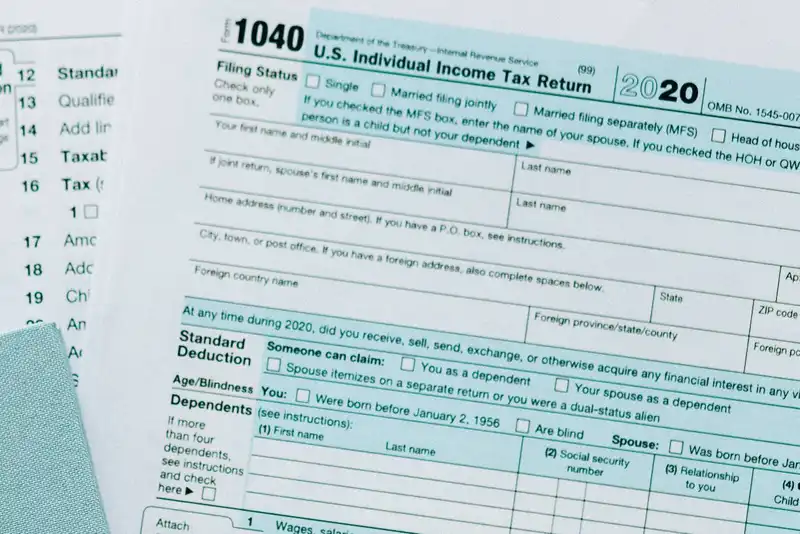

Documents for Financial Analysis

According to a recent study, 49% of companies are using data analytics more than they did before the COVID-19 pandemic. Many small businesses have been using data to understand their various departments, with 56% using it for finance. Organizations that want to perform successful financial analyses must evaluate various types of financial statements. The following are 3 critical statements that analysis relies on.

1. Balance Sheet

A balance sheet details all the resources that a company has during a given period. More specifically, the balance sheet reveals current assets and non-current assets. It also shows current liabilities and long-term debts. This information will help team leaders understand the company's financial standing at the present time.

2. Income Statement

An income statement is considered one of the core financial documents of a business. It highlights the company's financial performance during a specific time frame. The key details of an income statement include revenue earned, the number of expenses incurred, and net profit and loss. Equipped with this information, business owners can forecast their financial future and assess their goal achievement process.

3. Cash Flow Statement

A cash flow statement reveals how much cash a company has on hand during a specified period. It also shows the outflow of money in the business. This helps teams understand a company's bills, as well as their overall financial growth.

Elements of Financial Health in Financial Data Analytics

When using data analytics to assess a company's financial health, it is important to evaluate liquidity, leverage, and profitability. These internal factors cannot be controlled by the business. Therefore, by understanding these elements, teams can improve their decision-making and safeguard their finances.

Liquidity

Liquidity refers to how much cash and assets a business has on hand to pay its expenses, like bills and debts. Generally, all companies will need a specific amount of liquidity to be able to pay off their expenses. When a brand has a low level of liquidity, it means the business lacks capital. This also highlights how the company is demonstrating poor performance in the market.

Typically, levels of liquidity will change throughout different time periods. Factors, such as sales, seasonality, and economic fluctuations, will drive liquidity to evolve. Cash flow within a company will also shift and affect liquidity.

Leverage

Leverage is the amount of funds that a company borrowed from third parties to purchase inventory and other assets. Investors and bankers consider leverage an important factor in a business's finances.

Organizations will have a high leverage ratio when their debt surmounts their equity. This means the brand is more likely to be exposed to risks. However, these risks can increase the rate of returns. For example, a restaurant that borrows capital to finance an industry-grade oven can boost sales since it is producing more goods.

Profitability

Profitability measures a company's ability to generate profits over a period of time through its sales. It also refers to how efficient a business can create value for its shareholders. Many factors can impact profitability, such as market prices, consumer trends, and assets. A company's existing debts and expenses can also affect a brand's overall profitability.

Key Takeaways - Financial Data Analytics

- Financial data analytics is the practice of evaluating a company's finances and overall value.

- Performing financial analytics to understand a company's financial health can highlight many opportunities, such as improved decision-making.

- Many businesses are leveraging their access to data by gaining insight into their finances.

- When conducting financial data analytics, businesses must examine their balance sheet, income statement, and cash flow statement.

- To assess an organization's financial health, business teams need to consider 3 key elements. These factors include liquidity, leverage, and profitability.